missoula property tax increase

Residents inside the city will see no tax increases. The countys budget for the 2021 fiscal year includes 1707 million in overall revenue with 544 million in property taxes.

Missoula County Adopts Fy22 Budget State Reappraisals Lead To Property Tax Increase Missoula Current

This fiscal year the average Missoula County reappraisal was 15 higher.

. If Missoula County keeps its mill values the same this year as last year taxes on a 350000 home will still increase 161 this year. Missoula County Animal Control. The county saw its newly taxable property increase by about 6 million this year according to county CAO Chris Lounsbury with 1 million taking place outside city limits.

In his preliminary budget Missoula Mayor John Engen is proposing increased funding for law enforcement affordable housing and about 23 million in capital improvements during the 2021 fiscal year. Missoula County Detention Center. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700.

MIssoula County Grants Community Programs. The fiscal year 2021 budget for Missoula County will raise taxes for residents with a 350000 home who live outside the city limits and only pay county taxes an additional 1436 per year. Missoula County Courthouse Annex.

Thats a function of the the states appraisal process and tax system county officials said. Missoula County has one of the highest median property taxes in the United States and is ranked 374th of the 3143 counties in order of median property taxes. Under the new budget Missoula County residents with a 350000 home who live outside the city limits and only pay county taxes will pay an additional 1436 per year in property taxes and.

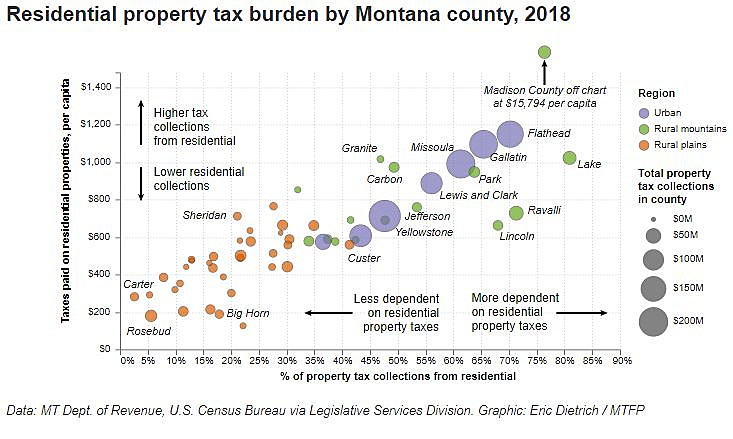

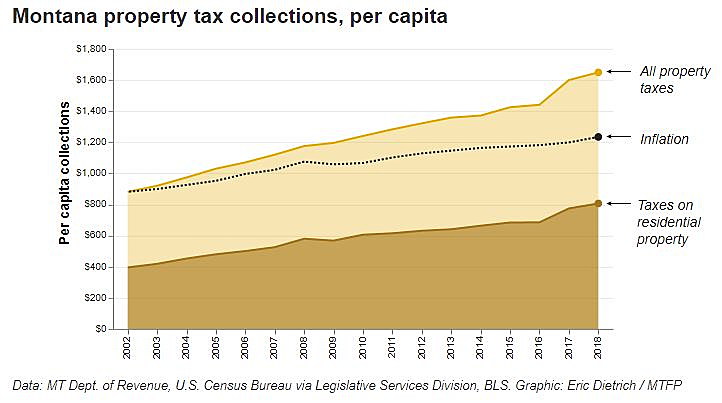

Property tax as a tool is basically maxed out The county is proposing a budgetary increase of 64 percent in Fiscal Year 2020 including a. These increases are considerably higher than Montanas average yearly property tax increase of 5 and drastically higher than the national yearly property tax increase average of roughly 32. Thats more than double the rate of the house with the smallest increase in our analysis house three.

The Missoula City Council has approved a measure to boost its fees for parks and the services it provides to the specific groups who use the citys facilities. The county saw its newly taxable property increase by about 6 million this year according to county CAO Chris Lounsbury with 1 million taking place outside city limits. Missoula County collects on average 093 of a propertys assessed fair market value as property tax.

Missoula County Community and Planning Services. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula.

Under the new budget Missoula County residents with a 350000 home who live outside the city limits and only pay county taxes will pay an additional 1436 per year in property taxes and homeowners within city limits with a home of. Missoula City-County Health Department. The countys previous mill value was 248456 though it increased to 275805 this year.

The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. The accuracy of this data is not guaranteed. The countys previous.

In fact if you took that homes property taxes in 2016 and applied the national average property tax increase. There are other taxing jurisdiction that impact that total calculation including MCPS the city and statewide schools Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. The notices for the 2019-2020 appraisal cycle are.

Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. The Missoula City Council is expected to approve a 385-percent property tax increase at its Monday meetingThe mayor announced the increase two weeks ago after announcing property valuations from. Property Tax data was last updated 04282022 1210 AM.

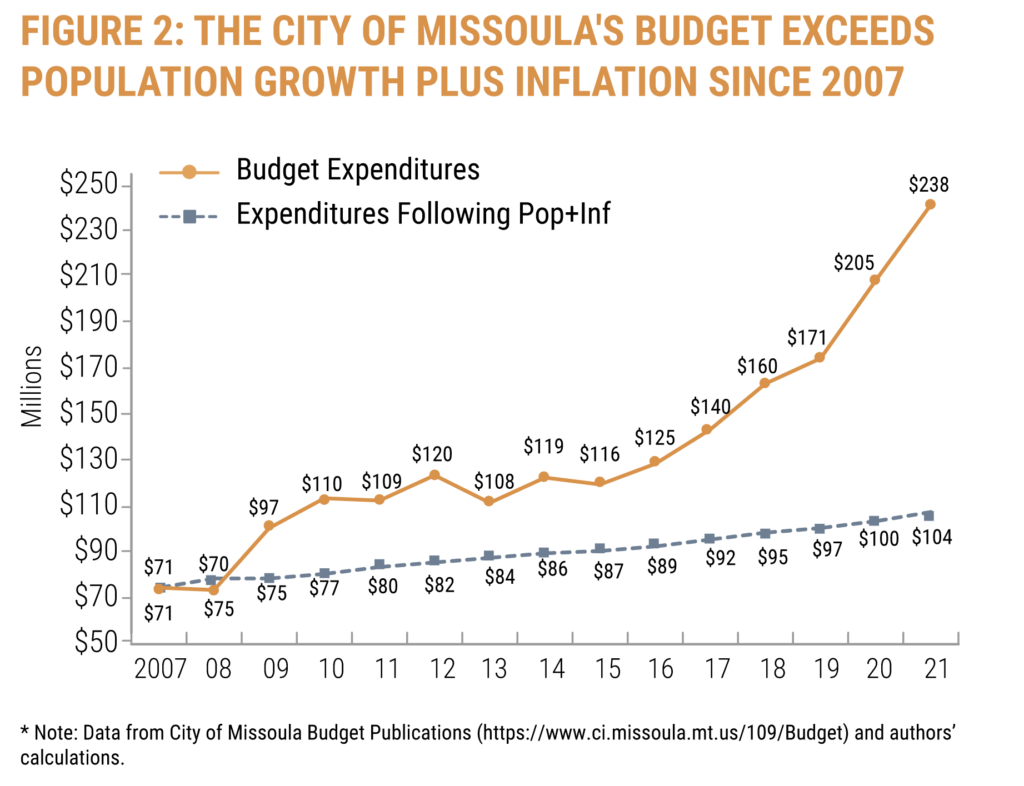

While it may seem small a few. Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending. You are visitor 4869037.

County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved bonds. The report found that the average yearly increase in each homes property taxes from 2016 to 2020 were 74 8 and 65. Missoula County Administration Building.

We basically have one source of revenue thats at our disposal and thats property taxes. Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020.

Property Taxes Missoula County Blog

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

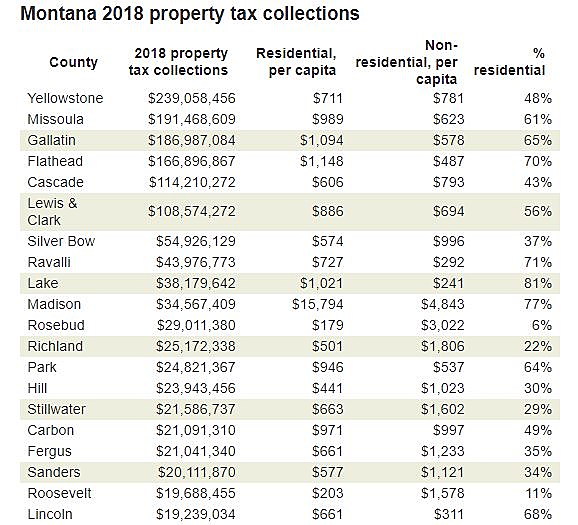

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Ci 121 Montana S Big Property Tax Initiative Explained

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Missoula County Launches New Property Tax Allowance Aimed At Solar Panels Missoula Current

Property Taxes Missoula County Blog

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

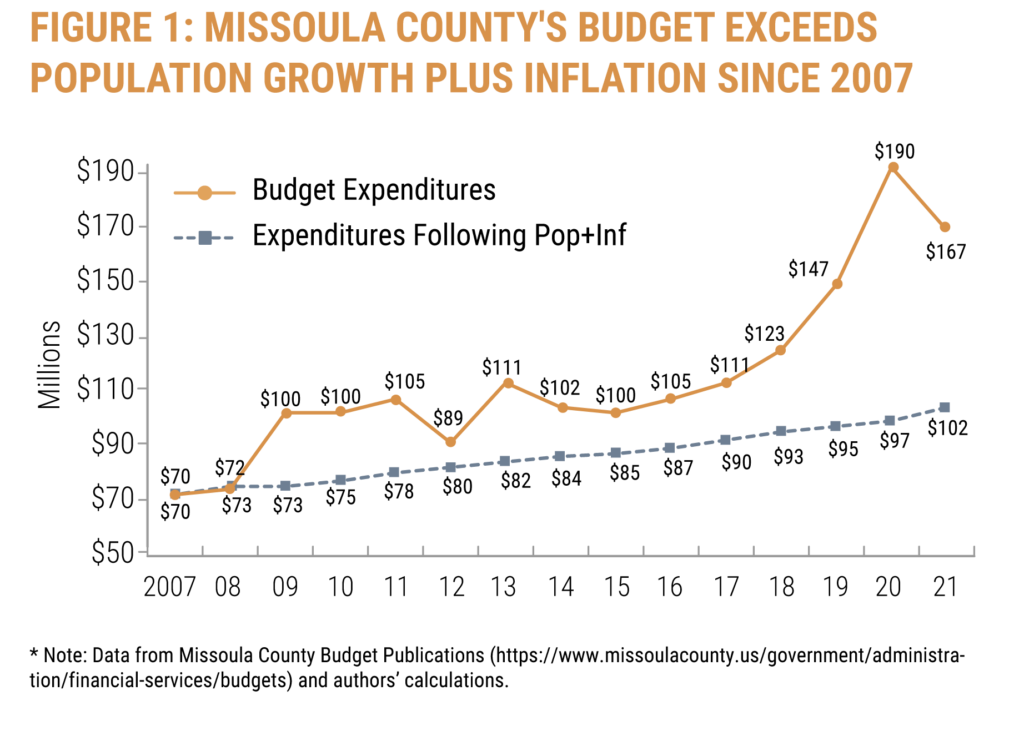

New Policy Brief The Real Missoula Budget

Property Taxes Missoula County Blog

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values Missoula Current